Legislation to restore the state and local tax (SALT) deduction introduced in 118th Congress | National Association of Counties

Eliminating the SALT Deduction Cap Would Reduce Federal Revenue and Make the Tax Code Less Progressive

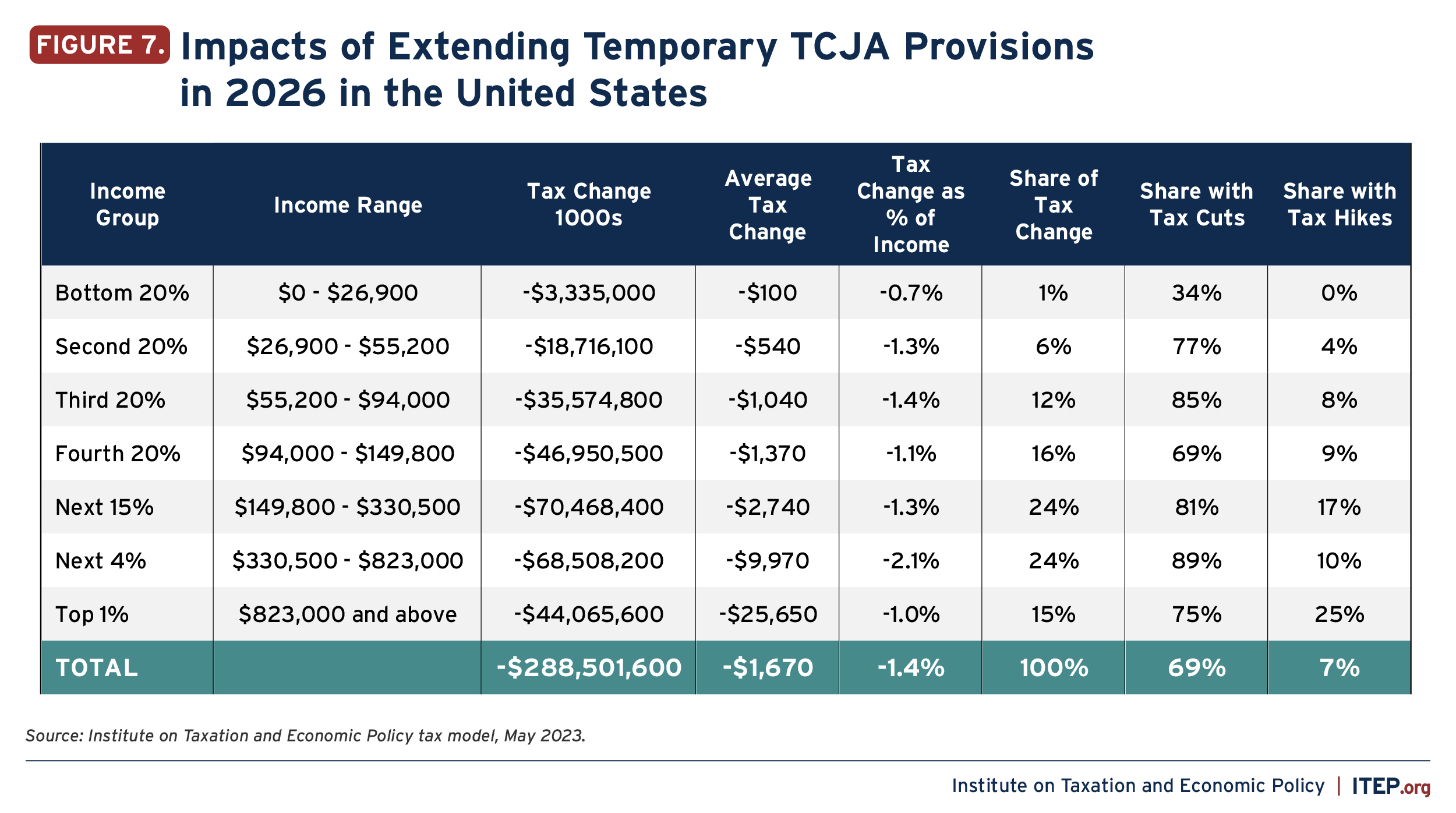

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates – ITEP

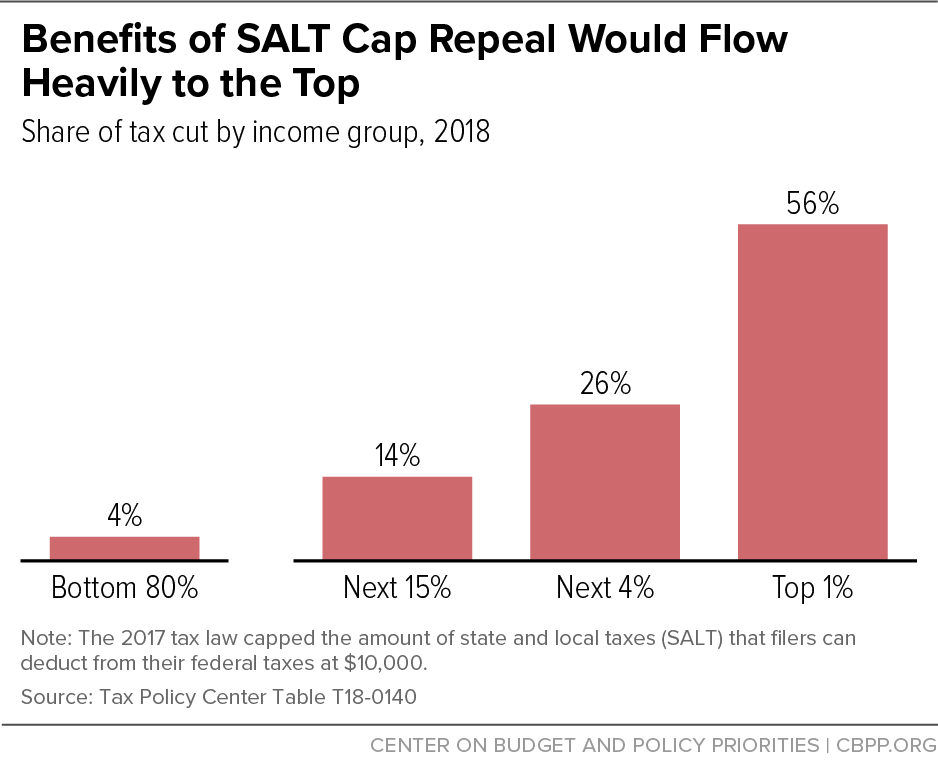

Repealing “SALT” Cap Would Be Regressive and Proposed Offset Would Use up Needed Progressive Revenues | Center on Budget and Policy Priorities

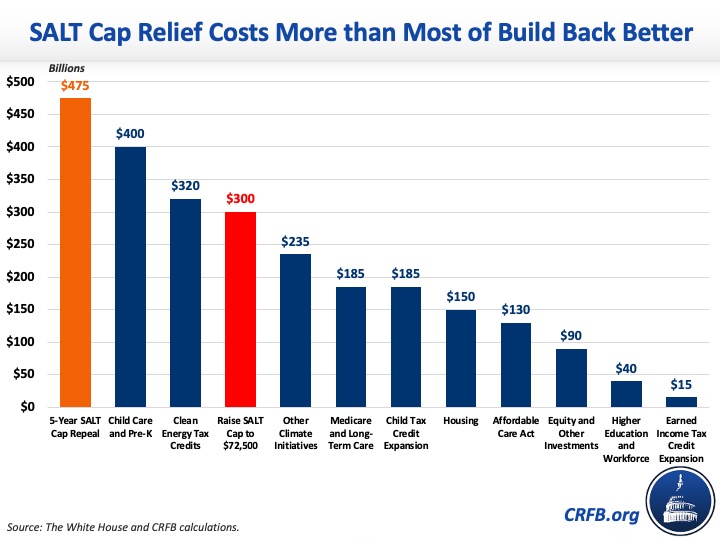

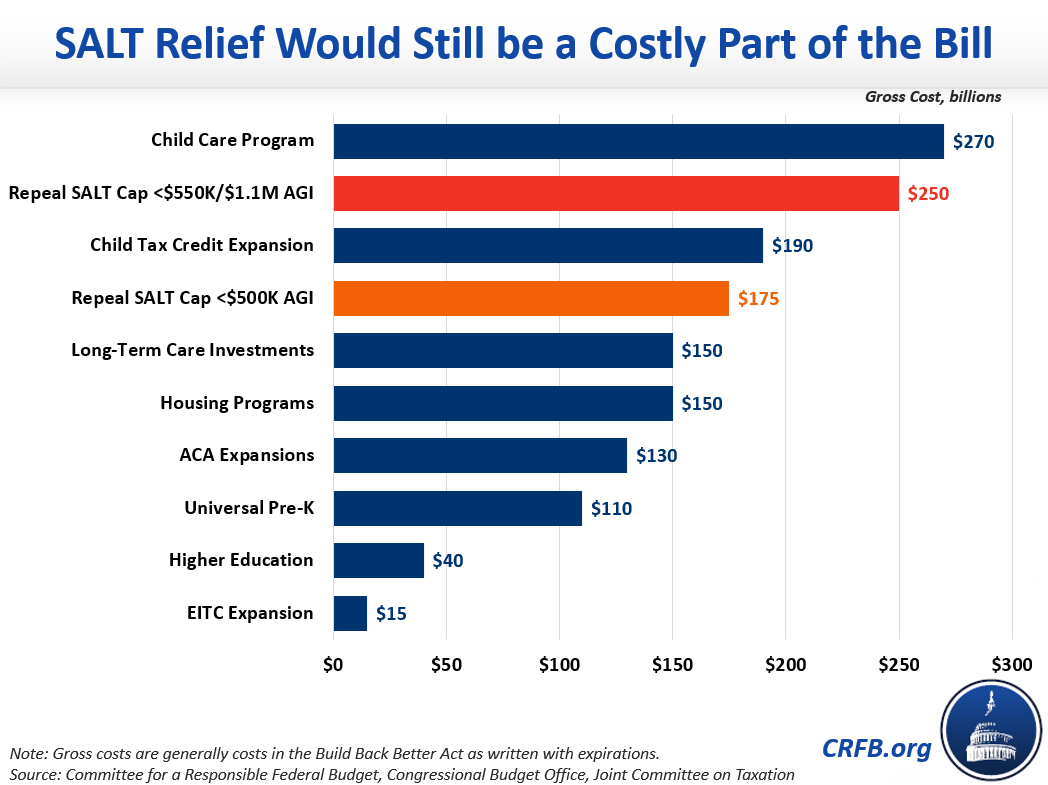

Revenue Neutral" SALT Cap Relief is Costly and Regressive | Committee for a Responsible Federal Budget

Repealing “SALT” Cap Would Be Regressive and Proposed Offset Would Use up Needed Progressive Revenues | Center on Budget and Policy Priorities

The Latest SALT Cap Fix Would Mostly Benefit High Income Households, Do Little For Middle-Income People | Tax Policy Center

Local House members, including Republicans, pushing to change key part of Trump tax law – Orange County Register

SALT Cap Repeal Below $500k Still Costly and Regressive | Committee for a Responsible Federal Budget